Investment Models

Across the Unbiased Financial Group we have a range of investment solutions. As discretionary wealth managers, we are one of only 300 firms (see unbiased portfolio management) that has the regulatory permissions to rebalance your holdings during the year without inconveniencing you.

We have the expertise and experience to invest into individual shares, investment trusts and unit trusts (see investment overview).

Portfolio Strategic Asset Allocation

Research prepared for the Financial Services Authority 1 has shown that the key influence on portfolio performance is likely to be the strategic asset allocation. Economies move in cycles and academic studies 2 have shown that over 90% of a portfolio's performance can be explained by performance of each of the asset classes.

Therefore, it is essential that a portfolio is constructed by using the asset classes of equities, fixed income, commodities, commercial property and cash in order to provide a balanced and diversified portfolio to maximise potential growth but minimise risk.

The objective is to blend asset classes together that have a low correlation, with the aim of smoothing out volatility to maximise risk-adjusted returns. There are 27 different sectors that we can invest into, from gilts to gold shares. Our goal is to preserve your capital by using 'modern portfolio theory' to create a portfolio with an 'efficient frontier' 3.

Fund Manager Selection

We use both quantitative and qualitative methodologies to identify the top fund managers in each sector. We combine information gathered from rating agencies, peer reviews, coupled with knowledge gained from our fund manager meetings. Typically, we meet with over 500 fund managers every year to monitor their performance. Our aim is to identify the fund managers that offer the best potential in each sector.

To spread risk within each sector we select from a range of different fund manager styles, e.g. GARP or value. We research the team looking at: depth, breadth, stability, resources, experience, culture, number of mandates and consistency. As each fund management group tends to pool fundamental research, we also spread risk across sectors by using a number of fund management groups. The overall aim is to create a diverse best-of-breed blended portfolio per sector.

Portfolio Composition

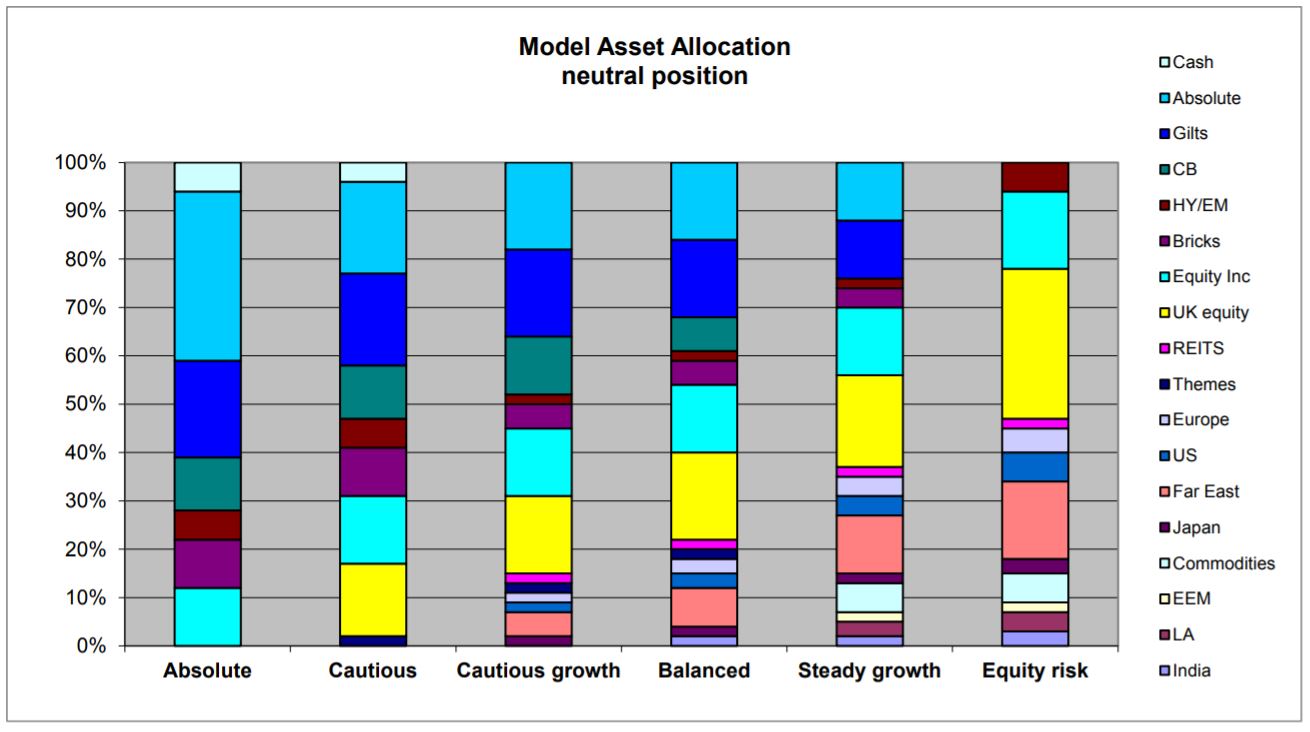

We have 6 risk-targeted models available to match the main client 'attitude to risk' types. The maximum equity exposure risk is shown below in brackets: Absolute (20%); Cautious managed (40%); Cautious growth (50%), Balanced managed (60%); Steady growth (80%); Equity risk (100%). We also have a withdrawal strategy for those in retirement to minimise sequencing risk.

For each model we blend sectors to create a 'best-practice' asset allocation. We use modern portfolio theory to identify the efficient frontier in order to create 'core and satellite' portfolios. For example in the equity risk model 2/3rds of the portfolio is invested in developed countries and small percentages are invested in more volatile sectors. An equity risk model portfolio could invest into 20 sectors, each with an average of 1.5 funds per sector.Therefore to reduce risk we typically invest into approximately 30 rated household-name funds.

We perform extensive research utilizing a range of tools to identify correlation between sectors, i.e: Portfolio Optimiser, Financial Express Analytics, Morningstar Adviser Workstation, Durable Portfolio Construction and Sharescope. This allows us to compare a fund's performance over discrete time periods. The goal is to identify the correlation between each fund and its sector, to enable comparison of portfolio models over different market conditions.

Using a sporting analogy, it's like selecting a national squad using the best players from England, Scotland, Ireland and Wales.

To ensure that there is no model style drift or increase in volatility there is a rigorous cross check before any rebalance is performed. Each fund is monitored monthly using ShareScope to ensure that the favourite funds (approximately 150) are performing consistently to their sector mandate. Additionally the performance of each model is monitored against its benchmark every week.

Active Tactical Asset Allocation

Inefficiencies exist within and between markets. Sometimes small cap stocks will outperform large cap stocks; and due to differences in the economic cycle interest rate differentials will be different between markets. Research 4 found that using tactical asset allocation to over or under weight between sectors, could account for almost 60% of the difference in returns between portfolios which used tactical asset allocation against portfolios with static strategic asset allocation.

Therefore, it is important that the portfolio is actively managed to tilt it between the assets classes and individual sectors. The aim is to be fully invested but when the equity markets are not trending upwards the portfolio may have a higher percentage in defensive areas e.g. fixed income, absolute bias funds or cash to reduce risk even further. On average this will involve tilting the portfolios 4 times a year.

Monitoring

We perform inter-market technical analysis daily on each of the sectors to identify if a trend is changing. We use the mean-reversion theory; i.e. when sectors become overbought and sentiment changes; we rotate the allocation into more defensive sectors. Also, if a sector breaks through a technical support level, we may take profits and switch into defensive funds. This is supplemented by the quantitative work performed daily by Quantitative Analysis Service, Inc. New Jersey.

Investment Committee

The investment committee (see unbiased portfolio management) meets monthly to discuss views of global economies and how they might impact the asset classes. This feeds into any tactical asset allocation adjustments to tilt the neutral positions for each of the 27 sectors in order to reduce risk and proactively prepare portfolios for headwinds.

We follow a number of contrarian indicators: e.g. Citibank Economic Surprise Index, currencies, commodities, derivatives market indices, sovereign yields, transaction volume, sentiment and market breadth. These give clues to when the equity markets are losing momentum.

Models

You can choose from the following multi-asset risk targeted models. Each model typically invests in collective funds and does not use complicated instruments as it is typically restricted by the platform. The aim of each model is as follows:

| Model | Objective |

| Absolute | Short term preservation of capital |

| Cautious managed: | Used to protect capital but with the potential of some upside to compensate for inflation. |

| Cautious growth: | With a maximum of 50% equity this could be used for protecting gains when the client is coming up to retirement. |

| Balanced managed: | Could be used for a long term investment with a client with a 'balanced' ATR |

| Steady growth: | Long term investment with a little volatility damping |

| Equity risk: | Long term international growth with the volatility of the FTSE |

| Income: | Smoothed income, but conscious of sequencing risk. |

We can create bespoke portfolios, utilise models or a hybrid. Most clients use the following models:

1 Charles River Associates, 2 Brinson, Hood and Beebower, 3 Markowitz and Sharp - best growth for a given risk, 4 Ibbotson and Kaplan.

Unbiased Financial Planning (UFP) is a trading name of Unbiased Financial Group LLP, which is authorised and regulated by the Financial Conduct Authority no 726137. Registered Office and Business Address: 37 Dorset Road, London, SW19 3EZ, Registered in England no: 6564739. Terms and Conditions. info@unbiasedfp.com Site developed by TC Designs.